Content

That change was driven by downward revisions to projections of distributions from retirement plans based on new data indicating that the amount of assets in retirement plans in recent years was less than previously estimated. Those reductions are partly offset by the effects of increased mandatory funding provided to the IRS by the 2022 reconciliation act. That funding will be spent on enforcement and other initiatives through 2031 and is projected to increase income tax collections by $186 billion over the 2023–2032 period. In the absence of more detailed information about how the IRS will use the funding, CBO has allocated about half of those additional revenues to individual income taxes and half to corporate income taxes. In the cost estimate for the 2022 reconciliation act, CBO estimated that the increase in funding for tax enforcement would increase revenues by $180 billion over the 2022–2031 period.

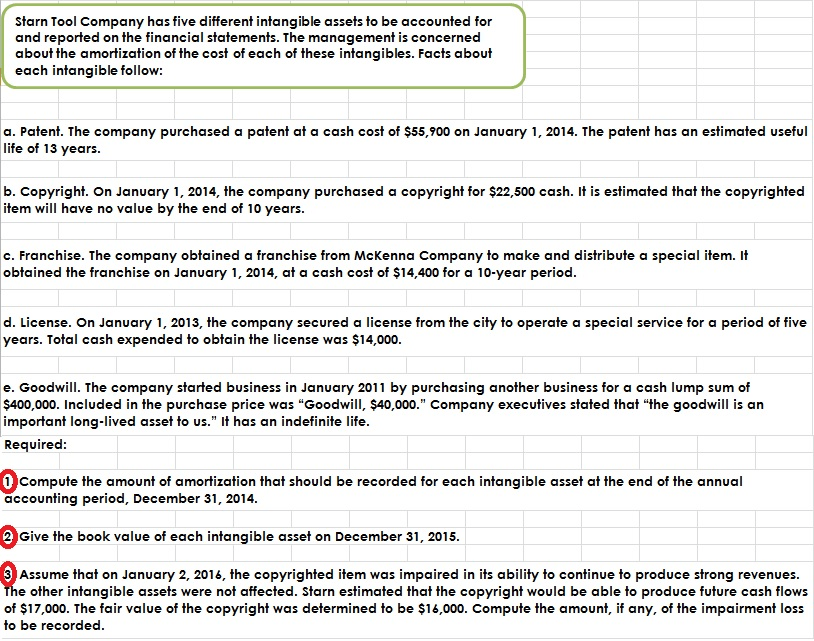

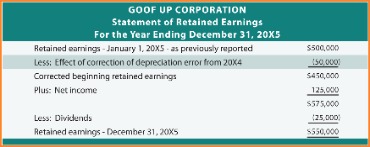

What is accumulated loss or accumulated deficit?

An accumulated deficit, also known as a retained earnings deficit or accumulated loss, occurs when a company's cumulative net losses exceed its cumulative net income. In other words, it's the total amount by which a company's losses have exceeded its profits since its inception.

Outlays from funding designated as an emergency requirement account for 8 percent of discretionary outlays in CBO’s baseline. Other mandatory spending—that is, all mandatory spending aside from that for Social Security and the major health care programs—is projected to drop by 0.4 percent of GDP in 2024, to 3.3 percent, in part because pandemic-related spending continues to dissipate. (Other mandatory spending peaked at 10.6 percent of GDP in 2021.) Such spending includes outlays for income support programs , military and civilian retirement programs, most veterans’ benefits, and major agriculture programs. Outlays for refundable tax credits total $107 billion in 2023 in CBO’s projections, $145 billion less than the amount recorded in 2022. Outlays for the child tax credit decrease by $106 billion this year, primarily because the temporary expansion of the child tax credit for calendar year 2021 expired. Coronavirus Refundable Credits and for the recovery rebates for individuals that were provided in response to the pandemic are projected to fall by $14 billion and $11 billion, respectively.

Net Income’s Effects on Stockholders’ Equity

Over the next two years, slowing demand for labor and falling inflation put downward pressure on the growth of wages. Nominal wage growth continues to gradually decline after 2024 but through 2027 remains above its annual average for the 2015–2019 period. Real federal government purchases are projected to grow by an average of 0.6 percent per year over that same period. CBO’s economic projections reflect the laws enacted accumulated deficit meaning and the policy measures taken through December 6, 2022, as well as the agency’s initial assessment at that time of discretionary funding for all of fiscal year 2023. An obligation limitation is a restriction—typically included in an appropriation act—on the amount, purpose, or period of availability of budget authority. The limitation often affects budget authority that has been provided in an authorization act.

- In financial modeling, it’s necessary to have a separate schedule for modeling retained earnings.

- $12 billion (12%) increase in Department of Veteran Affairs programs, primarily due to increased use of health care services and per capita increases in veterans’ benefits.

- In particular, CBO increased its projections of mandatory outlays for veterans’ benefits, as well as its overall projections of discretionary spending.

- The agency’s projection of real GDP growth for 2023, 0.1 percent, is considerably weaker than last spring’s forecast of 2.2 percent growth.

- This decrease is due to the expiration in September 2021 of enhanced benefits that were enacted earlier in the pandemic, as well as lower levels of unemployment.

CBO’s forecast for roughly zero growth of real GDP in 2023 is highly uncertain. A key risk stems from uncertainty about the future paths of inflation and interest rates. If inflation is higher than CBO expects, that will probably cause the Federal Reserve to raise interest rates higher and keep them elevated for longer than CBO anticipates. Those higher interest rates would put further downward pressure on the interest-sensitive sectors of the economy, such as residential investment, net exports, and business investment.

End of Period Retained Earnings

Total revenues so far in Fiscal Year 2019 increased by 0.1 percent ($2 billion), while spending increased by 9.4 percent ($93 billion), compared to the same period last year. The Congressional Budget Office reported that the federal government generated a $149 billion deficit in March, the sixth month of Fiscal Year 2019, for a total deficit of $693 billion so far this fiscal year. March’s deficit is 29 percent ($60 billion) less than the deficit recorded a year earlier in March 2018.

If unemployment rises less than expected, consumers will have more income to spend on discretionary goods and services. Furthermore, consumer confidence may be higher than expected because of less uncertainty about future employment. If unemployment rises more than expected, consumers may pull back on spending.

Tracking the Federal Deficit: June 2022

The weaker economic growth in 2023 is largely the result of slower growth of exports, private investment, and consumption. Those components of GDP then drive the more rapid growth of real GDP through 2027. Real GDP growth is 0.1 percentage point per year faster from 2028 to 2032 than it was in the agency’s forecast last spring because of greater net immigration and faster growth of output per worker. Compared with its May 2022 projections, CBO’s current projections show weaker economic growth in 2023 (0.1 percent versus 2.2 percent) and stronger growth in 2024 (2.5 percent versus 1.5 percent) and the following three years. As a result, the level of real GDP is 3.7 percent lower than in the previous forecast for the end of 2023 but only 0.2 percent lower for the end of 2027. In CBO’s forecast, economic output expands slightly less rapidly from 2028 to 2033 than it does over the 2024–2027 period.

Individual income taxes rise in relation to GDP over that period as real income growth pushes an increasing share of income into higher tax brackets—a phenomenon known as real bracket creep. Several provisions of the 2017 tax act affect corporate income tax receipts over the next decade and are estimated to reduce such receipts as a share of GDP by 0.2 percentage points, on net, from 2023 to 2033. The amount of the federal government’s net interest costs is determined by the outstanding debt and the average interest rate on that debt. Growth in net interest costs is mainly affected by changes in the average interest rate on federal debt and by the primary deficit, which requires the government to borrow more and thus increases debt held by the public.

In the first five months of FY2022, the federal government ran a deficit of $475 billion, 55% less than at this point in FY2021 ($1.047 trillion). The cumulative deficit for FY2022 thus far is $149 billion (24%) lower than even the deficit over the comparable period in FY2020, pre-dating the onset of the COVID-19 pandemic. The FY2022 cumulative deficit continues to more closely track pre-pandemic deficits, in contrast to the record-high levels of the past two years. Through the first seven months of FY2022, the federal government ran a deficit of $295 billion, $1.58 trillion (84%) less than at the same point in FY2021.

The average interest rate on debt reflects the interest rates on Treasury securities of different maturities, the maturity structure of the securities issued, and the costs of inflation-linked payments made on some of those securities. Revenues from estate and gift taxes totaled $33 billion, or 0.1 percent of GDP, in 2022. In CBO’s projections, discretionary funding for defense totals $891 billion in 2023, a $75 billion—or 9 percent—increase from the sum provided in 2022. Emergency-designated defense funding, which totaled $34 billion in 2022, dips slightly to $33 billion in 2023.

Economic changes to CBO’s projections for the 2023–2032 period increased outlays for SNAP by $34 billion and increased outlays for child nutrition programs by $30 billion . Those increases stemmed primarily from upward revisions to CBO’s projections of growth in food prices. Economic changes increased CBO’s estimate of mandatory outlays in 2023 by $38 billion , on net. Projections of mandatory outlays from 2023 to 2032 increased by $810 billion .

What is the accumulated deficit in IFRS?

The accumulated deficit is a note to the original retained earnings account. For any more asset and operation losses, companies continue to report them in retained earnings to increase the accumulated deficit, while maintaining the balances of other capital accounts as initially recorded.