For an extensive explanation of prepaid rent and other rent accounting topics, see our blog, Prepaid Rent and Other Rent Accounting for ASC 842 Explained (Base, Accrued, Contingent, and Deferred). To increase or decrease a rent receivable account balance, it’s always necessary to post journal entries to your company’s general ledger. Since the receivable is an asset to the company, a debit entry will increase its balance, while a credit entry will decrease it. For example, suppose a tenant makes monthly rental payments of $800 at the beginning of each month. On April 1, you will post a debit entry to the rent receivable account for $800 and post a corresponding credit entry to the rental revenue account for the same amount. However, once you receive the rental payment, you decrease the rent receivable account with an $800 credit entry and post a debit entry for the same amount to the company’s cash account.

Lease with option to buy occurs if the rental agreement gives your tenant the rights to buy your rental property. The payments you receive under the agreement are generally rental income. Security deposits used as a final payment of rent are considered advance rent. Do not include a security deposit in your income when you receive it if you plan to return it to your tenant at the end of the lease. But if you keep part or all of the security deposit during any year because your tenant does not live up to the terms of the lease, include the amount you keep in your income in that year. Rent received in advance is the amount of rent received before it was actually due, however, the related benefits equivalent to the advance received are yet to be provided to the tenant.

What Is the Difference Between Rent Expenses & Rent Payable?

Called lease expense under ASC 842, this aggregated expense is recorded in the operating section of the income statement. Expenses paid by tenant occur if your tenant pays any of your expenses. For example, your tenant pays the water and sewage bill for your rental property and deducts it from the normal rent payment. Under the terms of the lease, your tenant does not have to pay this bill. Include the utility bill paid by the tenant and any amount received as a rent payment in your rental income. If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned.

Companies often allocate a large part of their rental expense towards prime locations. For such companies, it’s crucial to weigh the cost of the rent against the benefits and potential boost in revenue that comes from being in a prime location. Rent expenses allow a business to exist commercially, settle commitments on time, and provide an environment where workers can perform adequately and thrive on a personal level.

What Is Rent Payable?

You must send a check to the lessor in a timely manner, lest the landlord initiate legal action against the business and threaten to seek an eviction order from a judge. A rent payment journal entry draws on a timing difference between the time rent becomes due and when a lessee extinguishes the related debt. When finance people talk about extinguishing a debt, they mean settling it.

- It also explains the appropriate recognition of rent expense, including an example demonstrating rent expense measurement, at the end of the article.

- Rent expense is incorporated into your operating expenses, while a rent payable entry reflects the money you need to send to a landlord to meet the terms of your lease.

- Security deposits used as a final payment of rent are considered advance rent.

- It is often, as mentioned above, listed as a selling or administrative expense.

- For simplicity, assume that the landlord owns just one property and the tenant pays rent only to this landlord.

- You must be able to substantiate certain elements of expenses to deduct them.

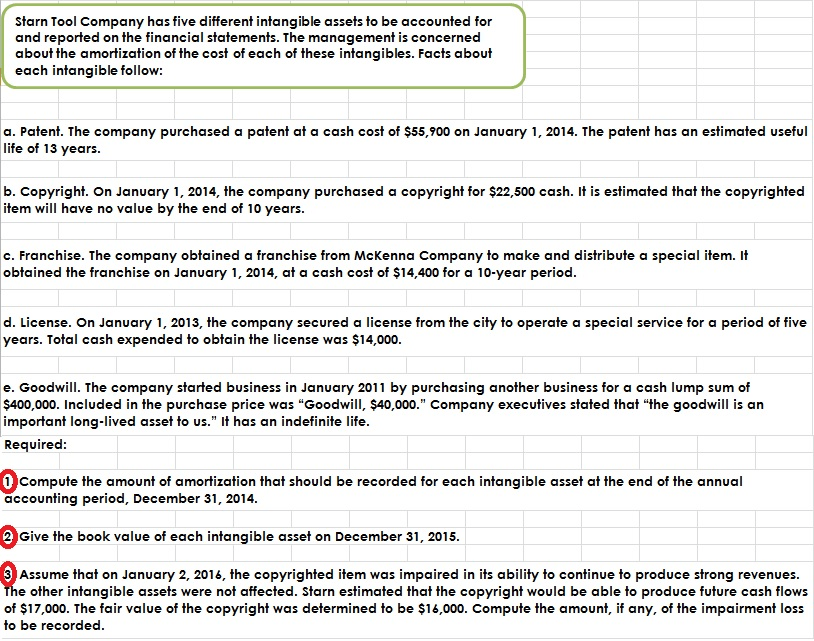

- A retailer enters into a 10-year warehouse lease with initial rent payments of $10,000 a month and a 2% annual rent escalation.

At transition, the cumulative balance in each of those accounts will be removed from the books and the ROU asset will be correspondingly adjusted. Since prepaid rent has a natural debit balance, it will need to be eliminated from the balance sheet with a credit and offset by a debit to the ROU asset, increasing the net asset balance. Deferred rent and accrued rent, being liabilities, will need to be debited in order to be derecognized, and the ROU asset will be respectively credited, decreasing the net asset balance. After the transition, the differences in the timing of cash flows and expense recognition will continue to be reflected in adjustments to the ROU asset balance.

The Rent Expense Account Belongs in Which Category of Accounts?

Setting up receivable accounts is an integral component of using an accrual method of accounting. In a rental property situation, you earn the rental income on each date that the lease agreement requires the tenant to make payment. For example, if you require tenants to make rent payments on the first of each month, you must increase the rent receivable What Is The Difference Between Rent Receivable And Rent Payable? or accrued rent account to reflect the payment you expect to receive from the tenant. When cash payments in a period were greater than the expense recognized, prepaid rent would be capitalized on the balance sheet with a debit balance. This was considered a prepayment, which is an asset, due to rent payments being greater than rent expense incurred.

Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance. The annual rent expense is $131,397 ($1,313,967 divided by 10 years), and the monthly rent expense is $10,950 ($1,313,967 divided by a lease term of 120 months). As was the case under ASC 840, rent expense is not reported on the balance sheet. It is still only reported on the income statement and calculated on a straight-line basis.

Keep track of any travel expenses you incur for rental property repairs. To deduct travel expenses, you must keep records that follow the rules in chapter 5 of Publication 463, Travel, Entertainment, Gift, and Car Expenses. If you own a part interest in rental property, you must report your part of the rental income from the property. Below are some tips about tax reporting, recordkeeping requirements and information about deductions for rental property to help you avoid mistakes. Show journal entries in the books of XYZ Ltd for rent received considering TDS & GST implications.

SF’s China Live could be evicted if it doesn’t pay $3.4M in rent – SFGATE

SF’s China Live could be evicted if it doesn’t pay $3.4M in rent.

Posted: Fri, 26 May 2023 21:39:55 GMT [source]

Example – On 20th December ABC Ltd received office rent from its tenant in cash 75,000 (25,000 x 3) for the next 3 months ie. This article discusses what rent expense is and how the new lease accounting standard, ASC 842, affects the presentation of rent expense in the financial https://kelleysbookkeeping.com/leverage-ratio-definition/ statements. It also explains the appropriate recognition of rent expense, including an example demonstrating rent expense measurement, at the end of the article. For simplicity, assume that the landlord owns just one property and the tenant pays rent only to this landlord.

Accounting Treatment for Rent Received

Example – XYZ Ltd charges monthly office rent of 100,000 from its tenant. On the 10th of every month, the tenant deducts TDS say 10% on the rent amount i.e. 100,000 at the time of payment of rent to XYZ Ltd. If you have any personal use of a dwelling unit that you rent (including a vacation home or a residence in which you rent a room), your rental expenses and loss may be limited. See Publication 527, Residential Rental Property, for more information.

What is the difference between rent and rent payable?

Rent expense and rent payable differ from an accounting standpoint, but they interrelate in operating activities. Rent expense is incorporated into your operating expenses, while a rent payable entry reflects the money you need to send to a landlord to meet the terms of your lease.