Dark pool investing has become one of the overwhelmingly most popular ways to trade stocks. In April 2019, the share of U.S. stock trades executed on dark pools and other off-market vehicles was almost 39%, according to a Wall Street Journal report. Our dark pools report identified how increasing the opacity of trading, principally through internalization, will undermine improvements in trading costs with impaired price determination and wider spreads. These private exchanges (also called Alternative Trading Systems) are known as “dark pools” due to their complete lack of transparency. Another use is in broker-led dark pools, where a broker can group various transactions among its own clients without having to route them out to a stock exchange.

Crypto Platform Launches ‘Dark Pool’ Citing Growing Institutional … – Blockworks

Crypto Platform Launches ‘Dark Pool’ Citing Growing Institutional ….

Posted: Thu, 08 Sep 2022 07:00:00 GMT [source]

Instead, transactions executed through dark pools are released to the consolidated tape after a delay. However, there have been instances of dark pool operators abusing https://forexhero.info/implementation-of-artificial-neural-network-for/ their position to make unethical or illegal trades. In 2016, Credit Suisse was fined more than $84 million for using its dark pool to trade against its clients.

Broker-dealer owned

Dark pools limit the reporting of these trades to the absolute bare minimum that is legally required. As a result, these trades rarely affect the price of the underlying instrument that was traded. In 2021, crypto investors heralded market movers, such as MicroStrategy and Tesla, as champions of the bull market. They represented the tip of an institutional iceberg of increasing interest in digital assets. By staying informed about the latest trends and changes in this space, traders and investors can make better-informed decisions about their trading strategies and stay ahead of the curve. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are two of the most important regulatory agencies that watch the dark pool market.

- However, an institutional investor possesses the buying power to purchase or sell enough securities to actually move the prices of the securities.

- Additionally, the use of dark pools can reduce liquidity in public markets.

- This means that institutional investors might be able to make trades at better prices than they could get in a liquid market.

- Some popular industry publications include Institutional Investor, The Trade, and Traders Magazine.

- Say ABC Investment Firm sees a good opportunity in Company 123 and decides to buy 20,000 shares in the company.

Dark Pools is an alternative trading system (ATS), which is a place where buyers and sellers can meet without their orders being shown to the public. Some ATSs are specifically designed for dark pool trading, while others offer a combination of dark pool and lit market trading. These funds typically have many investors who have invested in the fund, and the fund manager is responsible for executing trades on behalf of all of these investors. By using dark pools, mutual fund managers can make trades without letting the market know about all of their trades. This can help keep the trades private and stop other investors from “front-running” them. To execute the trade, the mutual fund manager would submit a buy order to the dark pool, indicating the number of shares it wishes to buy and the price it is willing to pay.

Day Trade the World Staff

However, the truth is that most individual investors have nothing to worry about with dark pools. Dark pools primarily exist to save small amounts of money and fees for institutional traders, and they are regulated and monitored closely by the SEC. Dark pools allow for trading execution away from the spotlight of public markets. Public markets tend to overreact or underreact due to news coverage and market sentiment. The pools facilitate trades that will trigger price overreaction or underreaction. Since HFT floods the trading volume on public exchanges, the programs need to find ways to break larger orders into smaller ones.

Do hedge funds use dark pools?

Investment banks or other financial institutions run most dark pools, and institutional investors like hedge funds and pension funds are the ones who use them the most. A dark pool's main purpose is to let institutional investors trade large blocks of securities without affecting the market price of those securities.

Since dark pool participants do not disclose their trading intention to the exchange before execution, there is no order book visible to the public. Trade execution details are only released to the consolidated tape after a delay. Paul is here today to take a large position in Crashproof, a small company that makes sensors for self-driving vehicles.

More Sophisticated Trading Strategies – The Impact of Technology on Dark Pool Trading

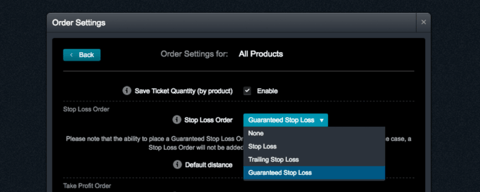

Before an order is eligible to be sent for execution, it must pass through a broker’s pre-trade risk check to ensure the order is not violating any pre-determined thresholds. If you’ve dealt with unreliable trading technology in the past year, you’re not alone. Both slow reporting and complete outages happened to several trading firms during high volatility days in 2021. Once the purchases are made, the purchase, for example, would be appropriately reported via a filing.

Since they can’t purchase these shares on the open market, the firm has to go onto a dark pool to make the purchase. Dark pool operators have also been accused of misusing their dark pool data to trade against their other customers or misrepresenting the pools to their clients. According toThe Wall Street Journal, securities regulators have collected more than $340 million from dark pool operators since 2011 to settle various legal allegations. Dark pools work without this transparency, allowing players to discretely (and anonymously) find a counterparty for the trade.

Example #1 – Dark Pools Being Used in Practice

There are possible conflicts of interest that take place within a dark pool that would be very hard to detect. Regulators and market participants have debated these potential conflicts of interest for as long as traders have been using dark pools. Just because dark pools are not national securities exchanges, it doesn’t mean you can’t find out more details about them. In fact, according to the SEC, an Alternative Trading System can apply to become a national exchange if it elects to. The Exchange also provides a monthly list of Dark Pools – an Alternative Trading System (“ATS”) List – on its site.

Cboe to launch Treasuries ‘dark pool’ by year-end – Risk.net

Cboe to launch Treasuries ‘dark pool’ by year-end.

Posted: Fri, 21 Oct 2022 07:00:00 GMT [source]

That said, the Financial Industry Regulatory Authority (FINRA) changed its requirements in 2014, making dark pools report the total amount of shares traded in individual stocks across dark pools. This provides some insight into whether big block transactions are happening in an individual equity. The rule would require brokerages to send client trades to exchanges rather than dark pools unless they can execute the trades at a meaningfully better price than that available in the public market. If implemented, this rule could present a serious challenge to the long-term viability of dark pools. With options two and three, the risk of a decline in the period while the investor was waiting to sell the remaining shares was also significant. Dark pools can have an effect on the prices of stocks and other securities, and different laws govern them.

The dark pool, therefore, is a place of exchange, where institutional investors (and connected wealthy individuals) can execute trades privately. In some cases, dark pools are accessible to the public via retail brokers. In regular exchanges, the order book is publicly available, so large orders can cause excitement or panic in the markets before the trade is even filled. Initially, institutional investors used dark pools, such as pension funds and hedge funds, to trade large blocks of securities without impacting the market price. But as electronic trading became more popular in the 2000s, dark pools became more common, and more investors could use them. To solve this problem, institutions set up “private exchanges” to facilitate larger trades and bypass this “market risk” of increased volatility and speculation.

Do dark pools increase liquidity?

Many private financial exchanges were established, and it facilitated traders who received very large orders and could not complete them on traditional public exchanges. Dark pools add to the efficiency of the market since there is additional liquidity for certain securities by getting them to list on the exchanges.